How to Swap Tokens on a DEX

Decentralized exchanges (DEXs) have revolutionized the way we trade cryptocurrencies, allowing users to swap tokens directly without the need for intermediaries. This article will guide you through the process of swapping tokens on a DEX, covering everything from the basics to advanced strategies, ensuring you have all the information you need to navigate this exciting aspect of the cryptocurrency industry.

Understanding Decentralized Exchanges

Decentralized exchanges operate on blockchain technology, enabling peer-to-peer trading of cryptocurrencies. Unlike centralized exchanges, DEXs do not hold users’ funds, which enhances security and privacy. Users retain control of their private keys, making DEXs a popular choice for those who prioritize security.

Benefits of Using a DEX

- Security: Users maintain control over their funds, reducing the risk of hacks associated with centralized exchanges.

- Privacy: DEXs often require minimal personal information, allowing for greater anonymity.

- Access to a Wide Range of Tokens: Many DEXs list a variety of tokens, including those not available on centralized platforms.

- Lower Fees: Trading fees on DEXs are typically lower than those on centralized exchanges.

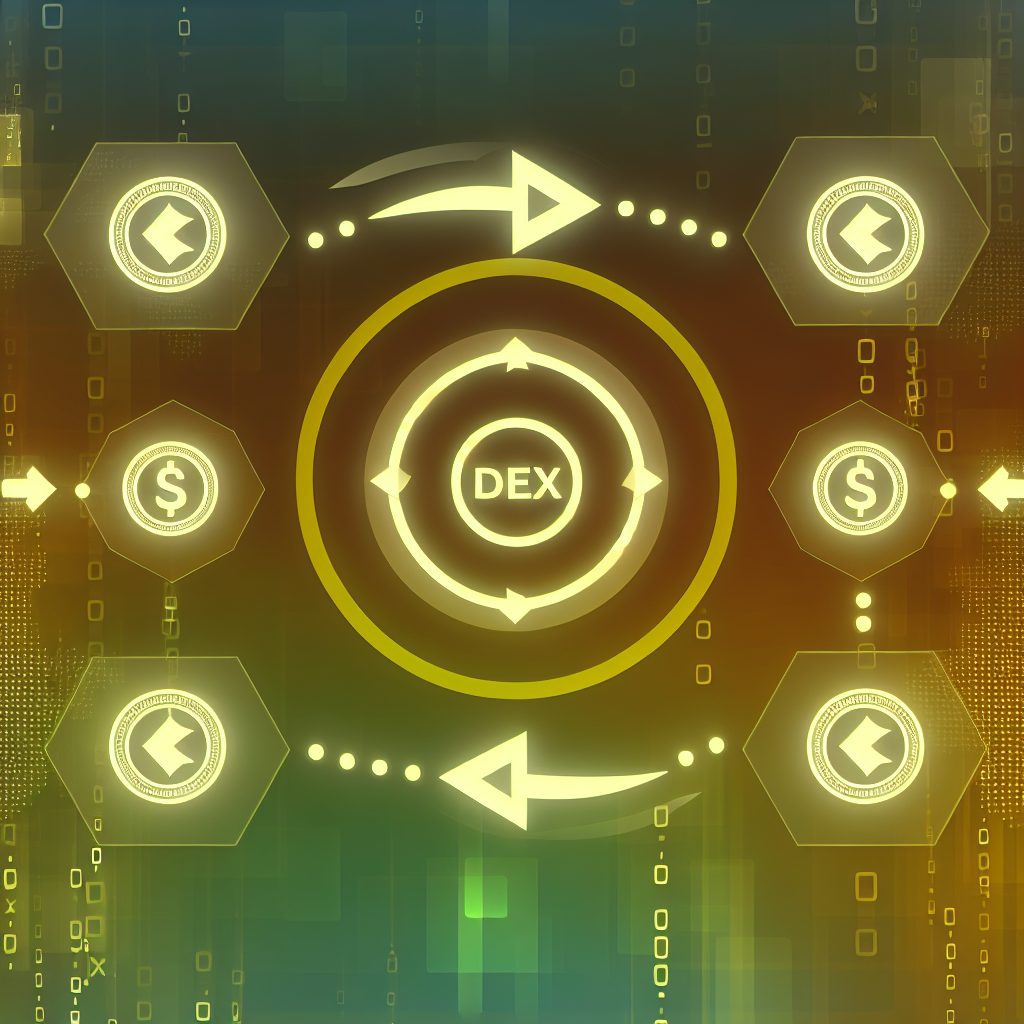

How to Swap Tokens on a DEX

Swapping tokens on a DEX can seem daunting at first, but the process is straightforward once you understand the steps involved. Here’s a step-by-step guide to help you through the process:

Step 1: Choose a DEX

There are several popular DEXs available, each with its unique features. Some of the most widely used include:

When selecting a DEX, consider factors such as liquidity, user interface, and supported tokens.

Step 2: Set Up a Wallet

To interact with a DEX, you need a cryptocurrency wallet that supports the tokens you wish to trade. Popular wallets include:

After setting up your wallet, ensure it is funded with the tokens you want to swap.

Step 3: Connect Your Wallet to the DEX

Once your wallet is set up and funded, navigate to the DEX website and look for the “Connect Wallet” button. Follow the prompts to connect your wallet. This process may vary slightly depending on the DEX and wallet you are using.

Step 4: Select Tokens to Swap

After connecting your wallet, you will see an interface for swapping tokens. Select the token you want to swap from and the token you want to receive. Ensure you have enough balance in your wallet for the swap, including any transaction fees.

Step 5: Review the Swap Details

Before confirming the swap, review the details carefully. Check the exchange rate, slippage tolerance, and any fees associated with the transaction. Slippage refers to the difference between the expected price of a trade and the actual price. Setting a slippage tolerance can help you avoid unexpected losses.

Step 6: Confirm the Swap

If everything looks good, confirm the swap. Your wallet will prompt you to approve the transaction. Once approved, the DEX will process the swap, and you will receive the new tokens in your wallet.

Step 7: Monitor Your Transaction

After confirming the swap, you can monitor the transaction on the blockchain using a block explorer like Etherscan for Ethereum-based tokens or BscScan for Binance Smart Chain tokens. This will allow you to verify that the transaction has been completed successfully.

Common Challenges When Swapping Tokens on a DEX

While swapping tokens on a DEX is generally straightforward, users may encounter some challenges:

- High Gas Fees: During periods of high network congestion, gas fees can spike, making swaps expensive. Consider timing your transactions during off-peak hours.

- Slippage: If the market is volatile, the price of tokens can change rapidly. Setting a higher slippage tolerance can help ensure your transaction goes through, but it may also result in a less favorable exchange rate.

- Token Compatibility: Not all tokens are available on every DEX. Ensure the tokens you wish to swap are supported by the platform you are using.

Advanced Strategies for Token Swapping

For those looking to optimize their trading experience on DEXs, consider the following advanced strategies:

1. Arbitrage Trading

Arbitrage involves taking advantage of price differences between different exchanges. If a token is priced lower on one DEX compared to another, you can buy it on the cheaper exchange and sell it on the more expensive one for a profit. This requires quick execution and a good understanding of market dynamics.

2. Liquidity Pools

Providing liquidity to a DEX can earn you rewards in the form of transaction fees. By depositing tokens into a liquidity pool, you facilitate trades and earn a share of the fees generated. However, be aware of impermanent loss, which can occur if the price of your deposited tokens changes significantly.

3. Limit Orders

Some DEXs offer limit orders, allowing you to set a specific price at which you want to buy or sell a token. This can help you avoid slippage and ensure you get the desired price for your trades.

Real-World Use Cases of DEXs

Decentralized exchanges have been instrumental in various real-world applications within the cryptocurrency ecosystem:

- Token Launches: Many projects use DEXs for initial token offerings (ITOs) or liquidity bootstrapping, allowing users to buy tokens directly from the project.

- Decentralized Finance (DeFi): DEXs play a crucial role in the DeFi space, enabling users to trade, lend, and borrow assets without intermediaries.

- Cross-Chain Swaps: Some DEXs facilitate swaps between different blockchains, expanding the possibilities for token trading.

Frequently Asked Questions (FAQs)

What is a DEX?

A decentralized exchange (DEX) is a platform that allows users to trade cryptocurrencies directly with one another without the need for a central authority or intermediary.

How do I choose the best DEX for swapping tokens?

Consider factors such as liquidity, supported tokens, user interface, and transaction fees when selecting a DEX.

Are DEXs safe to use?

While DEXs offer enhanced security by allowing users to retain control of their funds, they are not without risks. Always ensure you are using a reputable DEX and take necessary precautions to protect your wallet.

What are gas fees?

Gas fees are transaction fees paid to miners or validators for processing transactions on the blockchain. These fees can vary based on network congestion.

Can I swap tokens without KYC on a DEX?

Most DEXs do not require Know Your Customer (KYC) verification, allowing users to trade anonymously. However, this may vary by platform.

Conclusion

Swapping tokens on a DEX is an essential skill for anyone involved in the cryptocurrency market. By understanding the process and leveraging advanced strategies, you can enhance your trading experience and take advantage of the opportunities presented by decentralized finance. Always stay informed about market trends and developments by following trusted sources like Bitrabo.

For more insights and updates on cryptocurrency, follow me on X, Instagram, and Threads.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.