Crypto Wallets: Hot vs Cold Storage Explained

The world of cryptocurrency is vast and complex, with various tools and technologies designed to help users manage their digital assets. Among these tools, crypto wallets play a crucial role in the storage and management of cryptocurrencies. Understanding the differences between hot and cold storage is essential for anyone looking to invest in or use cryptocurrencies. This article delves into the nuances of these two types of wallets, their advantages and disadvantages, and how to choose the right one for your needs.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies. Unlike traditional wallets that hold physical cash, crypto wallets store the public and private keys needed to access and manage your digital assets. These keys are essential for conducting transactions on the blockchain.

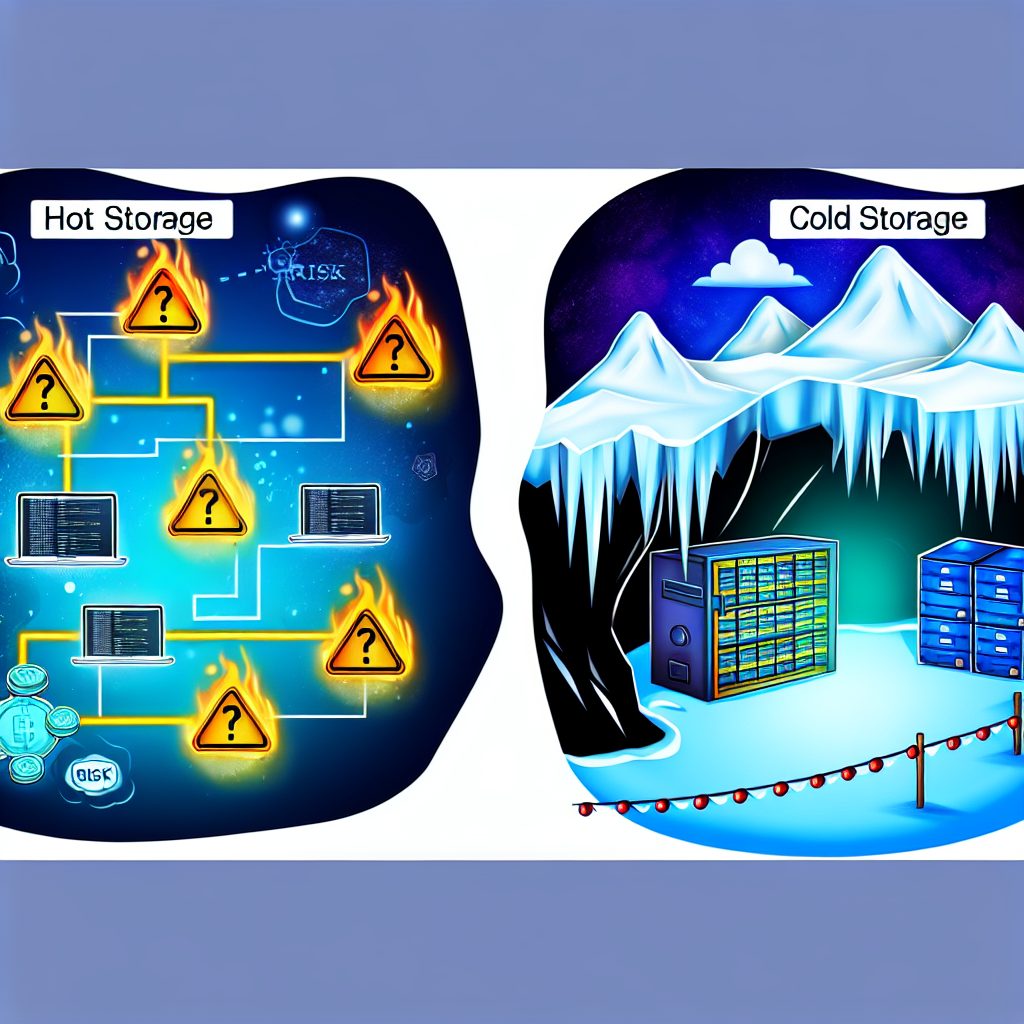

There are two primary types of crypto wallets: hot wallets and cold wallets. Each type has its unique features, benefits, and risks associated with it.

Understanding Hot Wallets

Hot wallets are connected to the internet, making them convenient for everyday transactions. They are typically used for quick access to funds and are ideal for users who frequently trade or spend their cryptocurrencies.

Types of Hot Wallets

- Web Wallets: Accessible through web browsers, these wallets are often provided by exchanges like Coinbase or Binance. They are user-friendly but can be vulnerable to hacking.

- Mobile Wallets: Apps installed on smartphones, mobile wallets offer convenience for on-the-go transactions. Examples include Trust Wallet and Mycelium.

- Desktop Wallets: Software installed on a personal computer, desktop wallets provide more security than web wallets but are still susceptible to malware and hacking.

Advantages of Hot Wallets

- Convenience: Hot wallets allow for quick access to funds, making them ideal for frequent transactions.

- User-Friendly: Most hot wallets have intuitive interfaces, making them accessible for beginners.

- Integration with Exchanges: Many hot wallets are integrated with cryptocurrency exchanges, facilitating easy trading.

Disadvantages of Hot Wallets

- Security Risks: Being online makes hot wallets vulnerable to hacking and phishing attacks.

- Less Control: Users may not have full control over their private keys, especially with web wallets.

- Potential for Loss: If a user loses access to their hot wallet, they may lose their funds permanently.

Exploring Cold Wallets

Cold wallets, on the other hand, are not connected to the internet, making them a more secure option for storing cryptocurrencies. They are ideal for long-term storage and for users who prioritize security over convenience.

Types of Cold Wallets

- Hardware Wallets: Physical devices like Ledger Nano S or Trezor that store private keys offline. They are considered one of the safest options for crypto storage.

- Paper Wallets: A physical printout of your public and private keys. While they are immune to online attacks, they can be easily lost or damaged.

- Air-Gapped Wallets: Devices that have never been connected to the internet, providing an extra layer of security.

Advantages of Cold Wallets

- Enhanced Security: Cold wallets are less susceptible to hacking and malware attacks due to their offline nature.

- Full Control: Users have complete control over their private keys, reducing the risk of third-party interference.

- Long-Term Storage: Ideal for holding large amounts of cryptocurrency for extended periods without the need for frequent access.

Disadvantages of Cold Wallets

- Less Convenient: Accessing funds can be cumbersome, especially for frequent transactions.

- Risk of Loss: If a user loses their hardware or paper wallet, they may lose access to their funds permanently.

- Initial Setup: Cold wallets may require a more complex setup process compared to hot wallets.

Choosing the Right Wallet for Your Needs

When deciding between hot and cold wallets, consider the following factors:

- Frequency of Transactions: If you plan to trade or spend your cryptocurrencies regularly, a hot wallet may be more suitable. For long-term holding, consider a cold wallet.

- Amount of Cryptocurrency: For small amounts, a hot wallet may suffice. For larger holdings, a cold wallet is recommended for enhanced security.

- Security Needs: Assess your comfort level with security risks. If you prioritize security, opt for a cold wallet.

Real-World Use Cases

Understanding how different wallets are used in real-world scenarios can provide valuable insights into their practical applications.

Case Study: The Mt. Gox Incident

The infamous Mt. Gox exchange hack in 2014 serves as a stark reminder of the vulnerabilities associated with hot wallets. At the time, Mt. Gox was handling approximately 70% of all Bitcoin transactions worldwide. The exchange was hacked, resulting in the loss of 850,000 Bitcoins, valued at around $450 million at the time. This incident highlighted the risks of keeping large amounts of cryptocurrency in hot wallets and underscored the importance of using cold storage for significant holdings.

Case Study: Ledger Hardware Wallets

Ledger, a leading provider of hardware wallets, has gained popularity among cryptocurrency enthusiasts for its robust security features. The Ledger Nano S and Nano X allow users to store multiple cryptocurrencies securely. With features like two-factor authentication and secure chip technology, Ledger wallets have become a preferred choice for long-term investors looking to safeguard their assets.

Statistics on Crypto Wallet Usage

Recent statistics reveal trends in crypto wallet usage:

- As of 2025, over 300 million crypto wallets have been created worldwide, indicating a growing interest in digital currencies.

- Approximately 60% of cryptocurrency holders use hot wallets for daily transactions, while 40% prefer cold storage for long-term investments.

- Security breaches in the crypto space have led to a 30% increase in the adoption of cold wallets among serious investors.

Frequently Asked Questions (FAQs)

What is the safest type of crypto wallet?

The safest type of crypto wallet is generally considered to be a hardware wallet. These devices store your private keys offline, making them less vulnerable to hacking and online threats.

Can I use both hot and cold wallets?

Yes, many users opt to use both hot and cold wallets. This strategy allows for quick access to funds for daily transactions while keeping the majority of assets securely stored in cold storage.

How do I secure my hot wallet?

To secure your hot wallet, consider the following measures:

- Enable two-factor authentication (2FA).

- Use strong, unique passwords.

- Regularly update your wallet software.

- Be cautious of phishing attempts and suspicious links.

What happens if I lose my cold wallet?

If you lose your cold wallet, such as a hardware wallet or paper wallet, you may lose access to your funds permanently unless you have a backup of your recovery phrase or private keys.

Are there fees associated with using crypto wallets?

Yes, some wallets may charge transaction fees, especially when sending or receiving cryptocurrencies. Additionally, hardware wallets have an upfront cost, while web wallets may have fees associated with trading or withdrawal.

Conclusion

Understanding the differences between hot and cold storage is crucial for anyone involved in the cryptocurrency space. Hot wallets offer convenience and ease of access, making them suitable for everyday transactions. In contrast, cold wallets provide enhanced security, making them ideal for long-term storage of significant amounts of cryptocurrency.

Ultimately, the choice between hot and cold wallets depends on individual needs, transaction frequency, and security preferences. By carefully considering these factors and staying informed about the latest developments in the crypto industry, users can make informed decisions to protect their digital assets effectively.

For more information on crypto wallets and security practices, consider visiting trusted sources such as CoinDesk and CoinTelegraph.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.