Understanding Impermanent Loss in LP Pools

In the world of decentralized finance (DeFi), liquidity pools (LPs) have emerged as a cornerstone for enabling trading without the need for traditional order books. However, while providing liquidity can be lucrative, it also comes with its own set of risks, the most notable being impermanent loss. This article delves into the intricacies of impermanent loss, its implications for liquidity providers, and strategies to mitigate its effects.

What is Impermanent Loss?

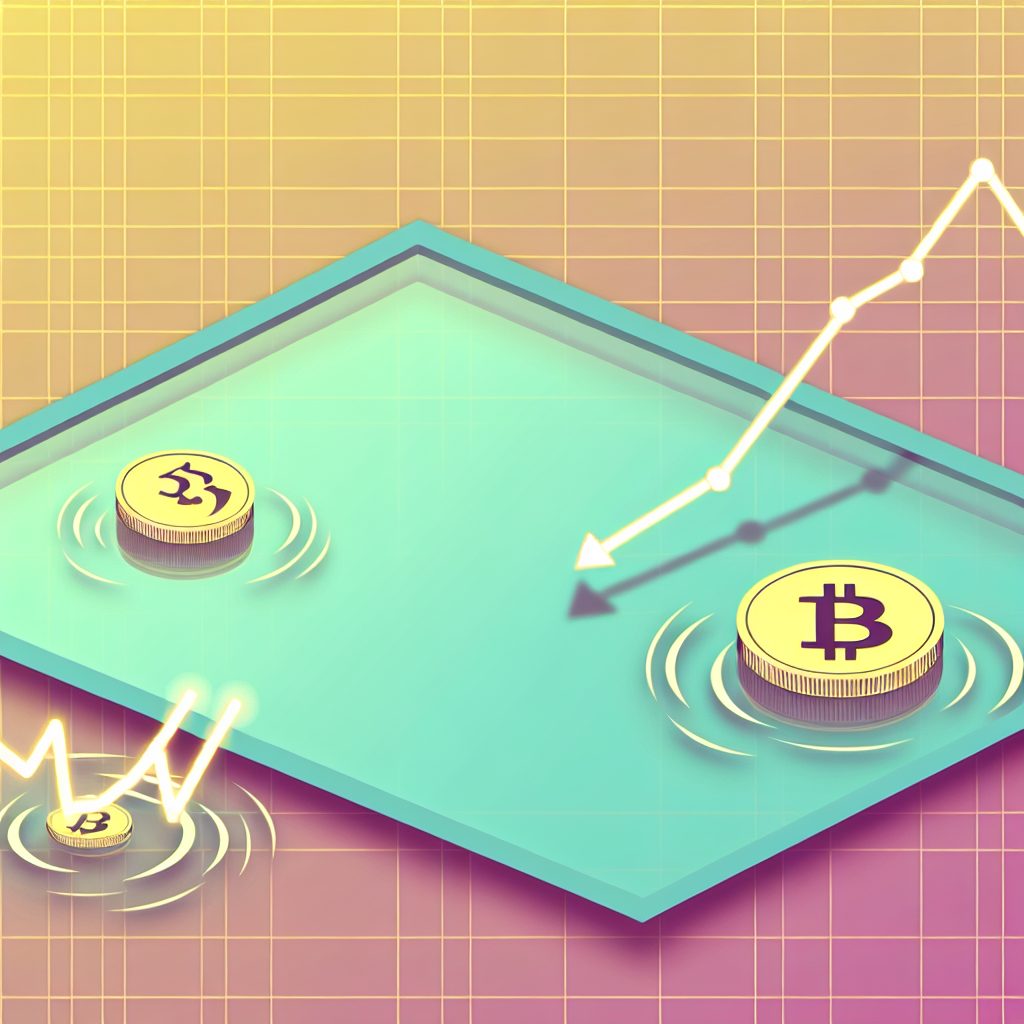

Impermanent loss</ refers to the temporary loss of funds that liquidity providers experience when the price of the assets in a liquidity pool diverges from their original price at the time of deposit. This phenomenon occurs in automated market makers (AMMs) like Uniswap, SushiSwap, and PancakeSwap, where liquidity is provided in pairs.

When a liquidity provider deposits two tokens into a pool, they expect to earn fees from trades that occur within that pool. However, if the price of one token increases significantly compared to the other, the liquidity provider may end up with a lower value of assets than if they had simply held the tokens outside the pool.

How Does Impermanent Loss Occur?

To understand impermanent loss, it’s essential to grasp how liquidity pools function. When you provide liquidity, you deposit two tokens in a specific ratio, typically 50/50. The AMM algorithm adjusts the token ratios based on supply and demand, which can lead to price divergence.

Here’s a simplified example:

- You deposit 1 ETH and 200 USDT into a liquidity pool.

- The price of ETH is $200 at the time of deposit.

- After some time, the price of ETH rises to $400.

In this scenario, if you had held your 1 ETH and 200 USDT, your total value would be $600. However, due to the price change, the AMM will adjust the token ratios, and you may end up with less ETH and more USDT, resulting in a total value of, say, $500. The difference of $100 is your impermanent loss.

Factors Influencing Impermanent Loss

Several factors contribute to the extent of impermanent loss:

- Price Volatility: The more volatile the assets in the pool, the greater the potential for impermanent loss.

- Time: The longer your assets remain in the pool, the higher the risk of price divergence.

- Liquidity Pool Composition: Pools with stablecoins tend to experience less impermanent loss compared to those with highly volatile assets.

Real-World Implications of Impermanent Loss

Understanding impermanent loss is crucial for liquidity providers. For instance, a liquidity provider who deposited assets into a volatile pool may find that their returns from trading fees do not compensate for the losses incurred due to price divergence. This can lead to a reevaluation of their strategy and risk tolerance.

Consider the case of a liquidity provider on Uniswap who added liquidity to an ETH/USDT pool. If ETH experiences a significant price surge, the provider may face substantial impermanent loss, especially if they do not actively manage their position. Conversely, if they had chosen a stablecoin pair, the risk of impermanent loss would have been minimized.

Strategies to Mitigate Impermanent Loss

While impermanent loss is an inherent risk in providing liquidity, there are several strategies that liquidity providers can employ to mitigate its effects:

- Choose Stablecoin Pairs: Providing liquidity in pools with stablecoins can significantly reduce the risk of impermanent loss.

- Monitor Market Conditions: Keeping an eye on market trends and price movements can help liquidity providers make informed decisions about when to enter or exit a pool.

- Utilize Impermanent Loss Protection: Some platforms offer insurance or protection against impermanent loss, allowing liquidity providers to hedge their risks.

- Diversify Liquidity Provision: Spreading investments across multiple pools can help mitigate the impact of impermanent loss in any single pool.

Case Studies: Learning from Liquidity Providers

Examining real-world case studies can provide valuable insights into how liquidity providers navigate impermanent loss. For example, a liquidity provider on SushiSwap who initially deposited assets into a volatile token pair may have experienced significant impermanent loss during a market downturn. However, by switching to a stablecoin pair, they were able to stabilize their returns and reduce risk.

Another example involves a provider who actively managed their position by withdrawing liquidity during periods of high volatility. This proactive approach allowed them to avoid substantial losses while still earning fees during stable periods.

Statistics on Impermanent Loss

Recent studies have shown that impermanent loss can significantly impact liquidity providers. According to a report by DeFi Pulse, liquidity providers in volatile pools can experience impermanent loss rates exceeding 30% during periods of high volatility. This statistic underscores the importance of understanding and managing impermanent loss for anyone looking to participate in DeFi.

FAQs about Impermanent Loss

What is the difference between impermanent loss and permanent loss?

Impermanent loss is a temporary loss that occurs when the price of assets in a liquidity pool diverges. Permanent loss, on the other hand, refers to a situation where the value of the assets decreases and does not recover, leading to a loss that cannot be reversed.

Can impermanent loss be avoided entirely?

While it cannot be completely avoided, liquidity providers can take steps to minimize its impact by choosing stablecoin pairs, monitoring market conditions, and diversifying their investments.

Is impermanent loss the same for all liquidity pools?

No, impermanent loss varies depending on the volatility of the assets in the pool, the time the assets are held, and the overall market conditions.

How can I calculate impermanent loss?

Impermanent loss can be calculated using various online calculators that take into account the initial and final prices of the assets in the pool. These tools can provide a clearer picture of potential losses.

Conclusion

Understanding impermanent loss is essential for anyone looking to provide liquidity in decentralized finance. By recognizing the factors that contribute to impermanent loss and employing strategies to mitigate its effects, liquidity providers can make informed decisions that enhance their overall returns. As the DeFi landscape continues to evolve, staying informed about risks and opportunities will be crucial for success.

For the latest updates on cryptocurrency news and price tracking, consider visiting Bitrabo. Follow me on social media for more insights: X, Instagram, and Threads.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before investing in cryptocurrencies.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.