Understanding Chain Reorg in Blockchain

In the world of blockchain technology, the term chain reorganization, often abbreviated as chain reorg, plays a crucial role in maintaining the integrity and security of decentralized networks. This phenomenon can have significant implications for cryptocurrency transactions, network stability, and overall trust in blockchain systems. In this comprehensive guide, we will delve into what chain reorgs are, how they occur, their implications, and real-world examples that illustrate their impact on the cryptocurrency industry.

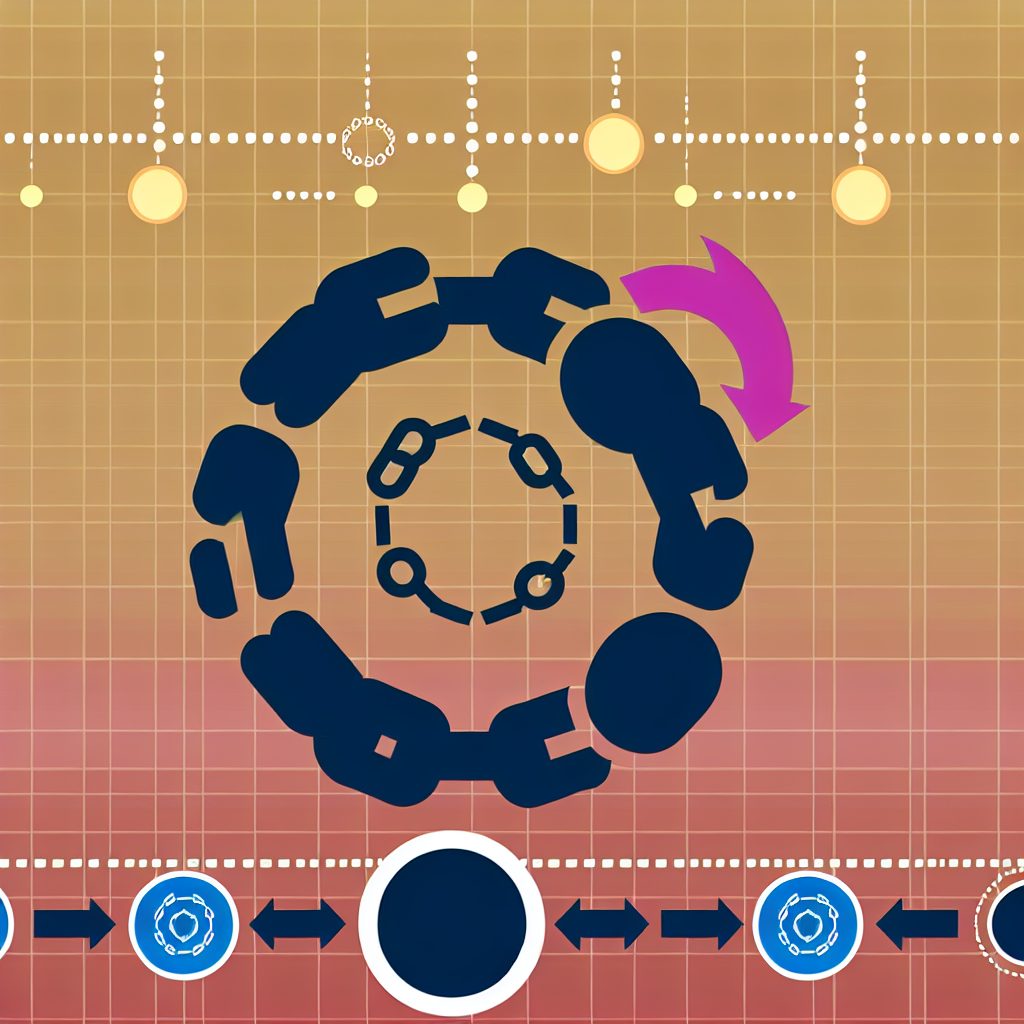

What is a Chain Reorg?

A chain reorganization occurs when a blockchain network temporarily diverges from its main chain, leading to a situation where a different version of the blockchain is accepted as the valid one. This can happen for various reasons, including network latency, mining competition, or malicious attacks. In essence, a chain reorg is a process where nodes in the network switch to a different chain that has a longer proof of work or a higher cumulative difficulty.

To understand chain reorgs better, it’s essential to grasp the concept of a blockchain. A blockchain is a distributed ledger that records transactions across multiple computers. Each block in the chain contains a set of transactions and is linked to the previous block, forming a secure and immutable record. When a new block is added, it is typically appended to the longest chain, which is considered the valid chain by the network.

How Do Chain Reorgs Occur?

Chain reorgs can occur due to several factors:

- Network Latency: When nodes in the network receive blocks at different times, it can lead to temporary forks. If one node receives a block before others, it may start building on that block, creating a split in the chain.

- Mining Competition: In proof-of-work systems, miners compete to solve complex mathematical problems. If two miners solve a block simultaneously, it can lead to a temporary fork until one chain becomes longer and is accepted by the network.

- Malicious Attacks: Attackers may attempt to create a longer chain by controlling a significant portion of the network’s hashing power. This is known as a 51% attack and can lead to a reorg that invalidates previous transactions.

Types of Chain Reorgs

Chain reorgs can be classified into two main types:

- Minor Reorgs: These involve a small number of blocks (usually one or two) and are relatively common in blockchain networks. They typically occur due to network latency or minor mining competition and are quickly resolved as nodes synchronize with the longest chain.

- Major Reorgs: These involve a significant number of blocks and can have serious implications for the network. Major reorgs may result from coordinated attacks or significant changes in mining power and can lead to substantial financial losses for users.

Implications of Chain Reorgs

Chain reorgs can have several implications for the cryptocurrency ecosystem:

- Transaction Finality: When a chain reorg occurs, transactions that were previously considered confirmed may become unconfirmed. This can lead to confusion and mistrust among users.

- Security Risks: Major reorgs can expose vulnerabilities in the network, making it susceptible to double-spending attacks and other malicious activities.

- Market Volatility: News of a significant chain reorg can lead to panic selling among investors, causing price fluctuations and market instability.

Real-World Examples of Chain Reorgs

Several notable incidents in the cryptocurrency space highlight the impact of chain reorgs:

The Ethereum Classic Reorg

In January 2019, Ethereum Classic (ETC) experienced a significant chain reorg that resulted in the reversal of over 88 blocks. This incident was attributed to a 51% attack, where an attacker gained control of the majority of the network’s hashing power. The attack led to the loss of millions of dollars worth of ETC and raised concerns about the security of smaller blockchain networks.

The Bitcoin Cash Reorg

In November 2018, Bitcoin Cash (BCH) underwent a contentious hard fork that resulted in a chain reorg. The split led to two competing chains: Bitcoin Cash ABC and Bitcoin Cash SV. The reorg caused confusion among users and exchanges, with some transactions being invalidated as the network settled on a new chain. This incident highlighted the challenges of governance and consensus in blockchain networks.

Preventing Chain Reorgs

While chain reorgs are a natural part of blockchain operation, there are several strategies that networks can implement to minimize their occurrence:

- Increasing Block Confirmation Times: By requiring more confirmations before considering a transaction final, networks can reduce the likelihood of reorgs affecting user transactions.

- Implementing Checkpoints: Some blockchains use checkpoints to establish certain blocks as permanent, making it more difficult for attackers to create a longer chain.

- Enhancing Network Security: Encouraging decentralization and preventing any single entity from gaining too much hashing power can help mitigate the risk of 51% attacks.

FAQs About Chain Reorgs

What happens to my transactions during a chain reorg?

During a chain reorg, transactions that were previously confirmed may become unconfirmed if they are part of a block that is dropped from the main chain. It’s essential to wait for multiple confirmations before considering a transaction final.

Can chain reorgs be prevented entirely?

While it’s impossible to eliminate chain reorgs completely, implementing best practices such as increasing block confirmation times and enhancing network security can significantly reduce their frequency and impact.

Are all blockchains susceptible to chain reorgs?

Yes, all blockchains can experience chain reorgs, but the frequency and impact can vary based on the consensus mechanism, network size, and security measures in place.

How can I protect my investments from chain reorgs?

To protect your investments, consider using wallets and exchanges that require multiple confirmations for transactions. Additionally, stay informed about the networks you invest in and their security measures.

Conclusion

Chain reorgs are an inherent aspect of blockchain technology, reflecting the decentralized nature of these networks. While they can pose risks to transaction finality and network security, understanding how they occur and their implications can help users navigate the cryptocurrency landscape more effectively. By implementing best practices and staying informed, both novice and experienced investors can mitigate the risks associated with chain reorgs.

For the latest updates on cryptocurrency news and price tracking, visit Bitrabo. Follow me on social media for more insights: X, Instagram, Threads.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your research before making investment decisions.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.