What Is a Reentrancy Attack?

In the world of cryptocurrency and blockchain technology, security is paramount. As decentralized applications (dApps) and smart contracts gain popularity, understanding potential vulnerabilities becomes crucial. One of the most notorious threats in this space is the reentrancy attack. This article delves into what a reentrancy attack is, how it works, its implications in the cryptocurrency industry, and ways to mitigate such risks.

Understanding Reentrancy Attacks

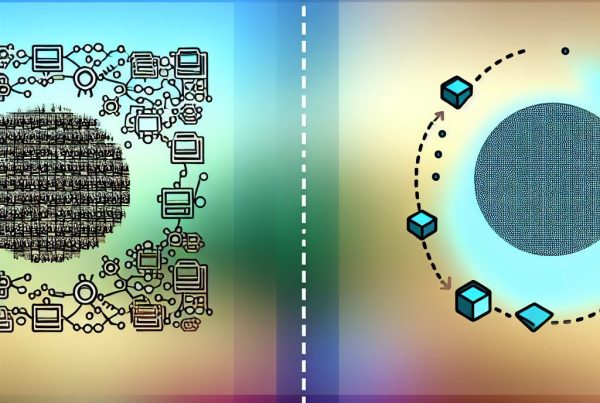

A reentrancy attack occurs when a smart contract calls another contract, and that second contract makes a recursive call back to the first contract before the initial execution is complete. This can lead to unexpected behavior and can be exploited to drain funds or manipulate the state of the contract.

To illustrate, consider a simple scenario where a user wants to withdraw funds from a smart contract. If the contract allows for a withdrawal function that calls an external contract, an attacker could exploit this by recursively calling the withdrawal function before the first call completes, effectively allowing them to withdraw more funds than they are entitled to.

How Reentrancy Attacks Work

Reentrancy attacks exploit the asynchronous nature of smart contracts. When a contract calls another contract, it does not wait for the second contract to finish executing before continuing its own execution. This can lead to a situation where the state of the first contract is not updated before the second contract is called again.

Here’s a step-by-step breakdown of how a reentrancy attack typically unfolds:

- Step 1: The attacker identifies a vulnerable smart contract that allows withdrawals.

- Step 2: The attacker creates a malicious contract that calls the vulnerable contract’s withdrawal function.

- Step 3: The vulnerable contract sends Ether to the malicious contract.

- Step 4: Before the vulnerable contract can update its balance, the malicious contract calls the withdrawal function again.

- Step 5: This process repeats, allowing the attacker to withdraw more funds than they should be able to.

Historical Context and Notable Incidents

Reentrancy attacks gained notoriety with the infamous DAO hack in 2016, where an attacker exploited a vulnerability in the DAO smart contract to siphon off approximately $60 million worth of Ether. This incident highlighted the critical need for robust security measures in smart contract development.

Another significant case occurred in 2020 with the Harvest Finance exploit, where attackers used a reentrancy attack to drain $24 million from the protocol. These incidents serve as stark reminders of the potential risks associated with poorly designed smart contracts.

Real-World Implications of Reentrancy Attacks

The implications of reentrancy attacks extend beyond individual projects; they can affect the entire cryptocurrency ecosystem. When a high-profile attack occurs, it can lead to:

- Loss of Trust: Users may lose confidence in decentralized applications and smart contracts, leading to decreased adoption.

- Market Volatility: Exploits can trigger significant price fluctuations in affected cryptocurrencies.

- Regulatory Scrutiny: Increased attacks may prompt regulators to impose stricter rules on smart contract development and auditing.

Preventing Reentrancy Attacks

Developers can implement several strategies to mitigate the risk of reentrancy attacks:

- Use the Checks-Effects-Interactions Pattern: This design pattern ensures that all state changes (effects) are made before any external calls (interactions) are executed.

- Implement Reentrancy Guards: A reentrancy guard is a mutex that prevents a function from being called while it is still executing.

- Limit External Calls: Minimize the number of external calls made within a contract to reduce the attack surface.

- Conduct Thorough Audits: Regularly audit smart contracts to identify and fix vulnerabilities before they can be exploited.

Case Studies of Reentrancy Attacks

Examining specific case studies can provide valuable insights into how reentrancy attacks are executed and how they can be prevented.

The DAO Hack

The DAO hack remains one of the most significant events in cryptocurrency history. The attacker exploited a reentrancy vulnerability in the DAO’s smart contract, allowing them to withdraw funds repeatedly. The incident led to a hard fork of the Ethereum blockchain, resulting in the creation of Ethereum (ETH) and Ethereum Classic (ETC).

Harvest Finance Exploit

In 2020, Harvest Finance fell victim to a reentrancy attack that exploited the protocol’s liquidity pools. The attacker manipulated the price of assets to drain funds from the protocol, resulting in a loss of $24 million. This incident prompted the team to implement additional security measures and highlighted the importance of robust smart contract design.

Best Practices for Smart Contract Development

To safeguard against reentrancy attacks, developers should adhere to best practices in smart contract development:

- Follow Security Guidelines: Utilize established security guidelines and frameworks for smart contract development.

- Test Extensively: Conduct thorough testing, including unit tests and integration tests, to identify potential vulnerabilities.

- Stay Informed: Keep up with the latest security trends and vulnerabilities in the blockchain space.

FAQs About Reentrancy Attacks

What is a reentrancy attack in cryptocurrency?

A reentrancy attack is a type of exploit where an attacker repeatedly calls a smart contract before its initial execution is complete, allowing them to manipulate the contract’s state and drain funds.

How can developers prevent reentrancy attacks?

Developers can prevent reentrancy attacks by using the Checks-Effects-Interactions pattern, implementing reentrancy guards, limiting external calls, and conducting thorough audits of their smart contracts.

What are some famous examples of reentrancy attacks?

Notable examples include the DAO hack in 2016 and the Harvest Finance exploit in 2020, both of which resulted in significant financial losses.

Why are reentrancy attacks a concern for the cryptocurrency industry?

Reentrancy attacks can lead to substantial financial losses, loss of user trust, market volatility, and increased regulatory scrutiny, all of which can hinder the growth of the cryptocurrency ecosystem.

Conclusion

Reentrancy attacks pose a significant threat to the security of smart contracts and decentralized applications in the cryptocurrency industry. Understanding how these attacks work and implementing best practices for smart contract development is essential for developers and users alike. By prioritizing security and staying informed about potential vulnerabilities, the industry can work towards creating a safer environment for all participants.

For the latest news and updates on cryptocurrency, including security practices and market trends, visit Bitrabo. Follow me on social media for more insights: X, Instagram, and Threads.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.