How Liquidity Mining Works

In the rapidly evolving world of cryptocurrency, liquidity mining has emerged as a pivotal mechanism that allows users to earn rewards by providing liquidity to decentralized finance (DeFi) platforms. This article delves into the intricacies of liquidity mining, its benefits, risks, and how it operates within the broader context of the cryptocurrency ecosystem.

Understanding Liquidity Mining

Liquidity mining is a process where cryptocurrency holders provide their assets to a liquidity pool in exchange for rewards, typically in the form of additional tokens. This practice is essential for decentralized exchanges (DEXs) and other DeFi platforms, as it ensures that there is enough liquidity for users to trade without significant price slippage.

At its core, liquidity mining incentivizes users to contribute their assets to a pool, which can then be used for various purposes, such as trading, lending, or borrowing. The rewards for liquidity providers (LPs) often come from transaction fees generated by the platform, as well as additional tokens distributed by the protocol.

How Liquidity Mining Works

The mechanics of liquidity mining can be broken down into several key steps:

- Choosing a Platform: Users select a DeFi platform that offers liquidity mining opportunities. Popular platforms include Uniswap, SushiSwap, and PancakeSwap.

- Providing Liquidity: Users deposit a pair of tokens into a liquidity pool. For example, on Uniswap, a user might deposit ETH and DAI.

- Receiving LP Tokens: In return for their contribution, users receive LP tokens, which represent their share of the liquidity pool.

- Earn Rewards: As trades occur within the pool, users earn a portion of the transaction fees. Additionally, many platforms offer governance tokens as rewards for liquidity providers.

- Withdrawing Liquidity: Users can withdraw their assets and any earned rewards at any time, although they may incur impermanent loss.

The Role of Automated Market Makers (AMMs)

Liquidity mining is closely tied to the concept of Automated Market Makers (AMMs). Unlike traditional exchanges that rely on order books, AMMs use algorithms to price assets based on supply and demand. This allows users to trade directly against a liquidity pool, which is funded by liquidity providers.

AMMs have revolutionized the trading experience by enabling users to trade assets without needing a counterparty. This innovation has made liquidity mining a viable option for many cryptocurrency holders looking to earn passive income.

Benefits of Liquidity Mining

Liquidity mining offers several advantages for both individual users and the broader cryptocurrency ecosystem:

- Passive Income: Users can earn rewards simply by providing liquidity, creating a source of passive income.

- Decentralization: Liquidity mining promotes decentralization by allowing anyone to participate in the liquidity provision process.

- Token Rewards: Many platforms offer governance tokens as rewards, giving users a say in the platform’s future direction.

- Market Efficiency: Increased liquidity leads to tighter spreads and better prices for traders, enhancing overall market efficiency.

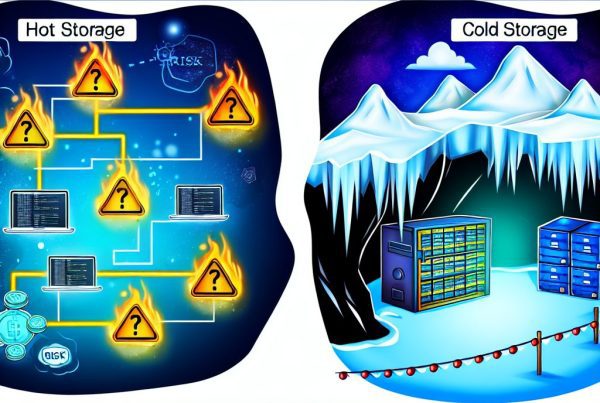

Risks Associated with Liquidity Mining

While liquidity mining can be lucrative, it is not without its risks. Users should be aware of the following potential downsides:

- Impermanent Loss: This occurs when the price of the tokens in the liquidity pool diverges significantly, leading to potential losses compared to simply holding the tokens.

- Smart Contract Risks: DeFi platforms are built on smart contracts, which can be vulnerable to bugs and exploits.

- Market Volatility: The cryptocurrency market is highly volatile, and sudden price swings can impact the value of the assets in the liquidity pool.

- Regulatory Risks: As the DeFi space grows, it may attract regulatory scrutiny, which could impact liquidity mining operations.

Real-World Applications of Liquidity Mining

Liquidity mining has found numerous applications across various DeFi platforms. Here are a few notable examples:

- Uniswap: One of the first and most popular DEXs, Uniswap allows users to provide liquidity for various token pairs and earn fees and UNI tokens as rewards.

- SushiSwap: A fork of Uniswap, SushiSwap introduced additional features like yield farming and governance, further incentivizing liquidity provision.

- PancakeSwap: Operating on the Binance Smart Chain, PancakeSwap offers lower fees and faster transactions, attracting liquidity providers looking for efficient trading options.

How to Get Started with Liquidity Mining

For those interested in diving into liquidity mining, here’s a step-by-step guide:

- Research Platforms: Investigate various DeFi platforms to find one that aligns with your investment goals and risk tolerance.

- Create a Wallet: Set up a cryptocurrency wallet that supports the tokens you plan to use for liquidity mining.

- Acquire Tokens: Purchase the necessary tokens to provide liquidity. Ensure you have both tokens in the pair you wish to deposit.

- Connect Your Wallet: Link your wallet to the chosen DeFi platform.

- Deposit Tokens: Navigate to the liquidity pool section and deposit your tokens.

- Monitor Your Investment: Keep track of your rewards and be mindful of market conditions to manage risks effectively.

Frequently Asked Questions (FAQs)

What is liquidity mining?

Liquidity mining is the process of providing liquidity to a decentralized finance platform in exchange for rewards, typically in the form of tokens.

How do I earn rewards from liquidity mining?

Users earn rewards by depositing tokens into a liquidity pool, where they receive a share of transaction fees and additional tokens from the platform.

What is impermanent loss?

Impermanent loss occurs when the price of tokens in a liquidity pool diverges significantly, leading to potential losses compared to simply holding the tokens.

Is liquidity mining safe?

While liquidity mining can be profitable, it carries risks such as impermanent loss, smart contract vulnerabilities, and market volatility. Users should conduct thorough research before participating.

Can I withdraw my liquidity at any time?

Yes, users can withdraw their liquidity and earned rewards at any time, although they may incur impermanent loss depending on market conditions.

Conclusion

Liquidity mining represents a significant innovation in the cryptocurrency space, enabling users to earn rewards while contributing to the liquidity of decentralized platforms. By understanding how liquidity mining works, its benefits, and associated risks, users can make informed decisions about their participation in this exciting aspect of DeFi.

As the DeFi landscape continues to evolve, staying updated on trends and developments is crucial. For the latest news and price tracking in the crypto world, consider visiting Bitrabo. Follow me on X, Instagram, and Threads for more insights and updates.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before investing in cryptocurrencies.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.