How Blockchain Solves Double-Spend Problems

The cryptocurrency industry has revolutionized the way we think about money, transactions, and trust. At the heart of this transformation lies a critical challenge: the double-spend problem. This issue arises when a digital currency can be spent more than once, undermining its integrity and value. Fortunately, blockchain technology offers a robust solution to this problem, ensuring that each transaction is unique and verifiable. In this article, we will delve into how blockchain effectively addresses the double-spend problem, its implications for the cryptocurrency industry, and real-world applications that highlight its effectiveness.

Understanding the Double-Spend Problem

The double-spend problem is a fundamental issue in digital currency systems. Unlike physical cash, which can only be spent once, digital currencies exist as data that can be copied. This raises the risk that a user could attempt to spend the same digital coin multiple times. If left unchecked, this could lead to inflation and a loss of trust in the currency.

To illustrate, consider a scenario where Alice has 1 Bitcoin. If she sends this Bitcoin to Bob while simultaneously attempting to send the same Bitcoin to Charlie, both Bob and Charlie could believe they have received the same Bitcoin. This situation creates chaos in the financial system, as it undermines the very concept of ownership.

The Role of Blockchain in Preventing Double Spending

Blockchain technology provides a decentralized ledger that records all transactions across a network of computers. This transparency and immutability are key to preventing double spending. Here’s how blockchain effectively addresses the double-spend problem:

1. Decentralization

In a traditional banking system, a central authority verifies transactions. However, in a blockchain network, no single entity has control. Instead, multiple nodes (computers) validate transactions, making it nearly impossible for any one party to manipulate the system. This decentralization ensures that once a transaction is recorded, it cannot be altered or duplicated.

2. Consensus Mechanisms

Blockchain networks utilize consensus mechanisms to agree on the validity of transactions. The most common mechanisms include:

- Proof of Work (PoW): Used by Bitcoin, this method requires miners to solve complex mathematical problems to validate transactions. Only after solving these problems can a block be added to the blockchain.

- Proof of Stake (PoS): In this system, validators are chosen based on the number of coins they hold and are willing to “stake” as collateral. This method is more energy-efficient than PoW.

- Delegated Proof of Stake (DPoS): This variant allows stakeholders to vote for delegates who validate transactions on their behalf, increasing efficiency.

These mechanisms ensure that all nodes in the network agree on the state of the blockchain, making it extremely difficult for any user to double-spend their coins.

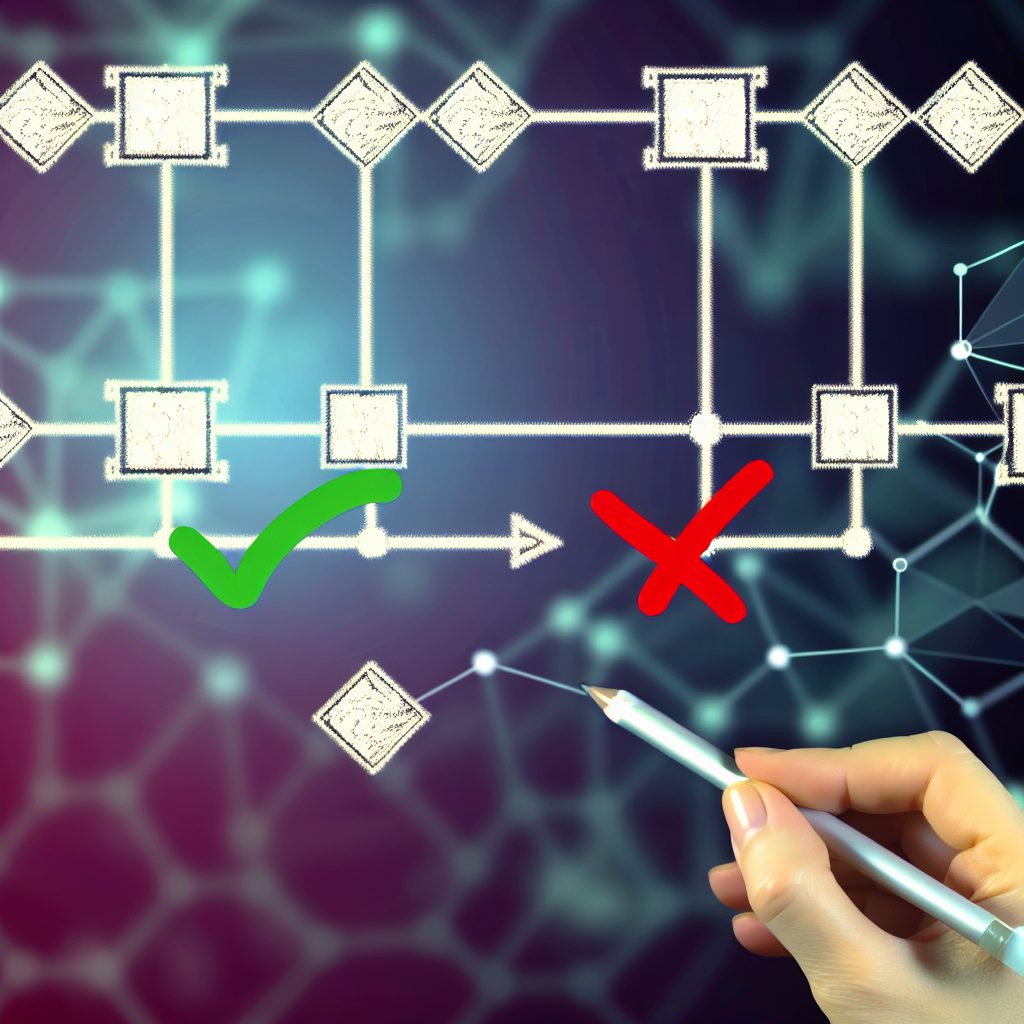

3. Transaction Verification

When a transaction is initiated, it is broadcasted to the network. Nodes then verify the transaction against the existing blockchain. If the transaction is valid and the sender has sufficient balance, it is added to a new block. This block is then linked to the previous block, creating a chain of transactions that is immutable.

4. Timestamping

Each transaction on the blockchain is timestamped, providing a chronological order of events. This feature allows the network to track the history of each coin, ensuring that it cannot be spent more than once. If a user attempts to double-spend, the network will recognize that the coin has already been used in a previous transaction.

Real-World Applications of Blockchain in Preventing Double Spending

Several cryptocurrencies and blockchain projects have successfully implemented solutions to the double-spend problem. Here are a few notable examples:

Bitcoin

As the first cryptocurrency, Bitcoin employs a robust proof-of-work consensus mechanism to prevent double spending. Each transaction is verified by miners, and once confirmed, it becomes part of the immutable blockchain. This system has proven effective, with Bitcoin processing millions of transactions without a single successful double-spend.

Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization, uses a similar approach but is transitioning to a proof-of-stake model with Ethereum 2.0. This upgrade aims to enhance scalability and security while maintaining the integrity of transactions, effectively preventing double spending.

Ripple

Ripple operates differently from traditional cryptocurrencies. It uses a consensus ledger and a unique consensus algorithm that allows for quick transaction validation. Ripple’s system is designed for financial institutions, ensuring that transactions are secure and preventing double spending in real-time.

Statistics on Blockchain and Double Spending

Understanding the impact of blockchain on the double-spend problem can be illustrated through various statistics:

- According to a report by Statista, the total transaction volume of cryptocurrencies reached over $10 trillion in 2023.

- Blockchain technology has been shown to reduce transaction fraud by up to 80%, according to a study by IBM.

- As of 2025, Bitcoin has processed over 700 million transactions without a successful double-spend incident.

Challenges and Limitations of Blockchain

While blockchain technology offers significant advantages in preventing double spending, it is not without its challenges:

1. Scalability

As the number of transactions increases, blockchain networks can face scalability issues. For instance, Bitcoin can process approximately 7 transactions per second, while Ethereum can handle around 30. This limitation can lead to delays and increased transaction fees during peak times.

2. Energy Consumption

Proof-of-work mechanisms, particularly in Bitcoin, require substantial energy resources. This has raised concerns about the environmental impact of mining operations. Transitioning to more sustainable consensus mechanisms, such as proof of stake, is a potential solution.

3. Regulatory Challenges

The regulatory landscape for cryptocurrencies is still evolving. Governments worldwide are grappling with how to regulate digital currencies while fostering innovation. Uncertainty in regulations can impact the adoption and use of blockchain technology.

FAQs about Blockchain and Double Spending

What is double spending in cryptocurrency?

Double spending refers to the risk that a digital currency can be spent more than once. It poses a significant threat to the integrity of digital currencies.

How does blockchain prevent double spending?

Blockchain prevents double spending through decentralization, consensus mechanisms, transaction verification, and timestamping, ensuring that each transaction is unique and verifiable.

Can double spending occur in blockchain networks?

While theoretically possible, double spending is extremely unlikely in well-designed blockchain networks due to their consensus mechanisms and transaction verification processes.

What are some examples of cryptocurrencies that prevent double spending?

Bitcoin, Ethereum, and Ripple are notable examples of cryptocurrencies that effectively prevent double spending through their respective blockchain technologies.

Conclusion

Blockchain technology has emerged as a powerful solution to the double-spend problem, ensuring the integrity and security of digital currencies. Through decentralization, consensus mechanisms, and transaction verification, blockchain provides a transparent and immutable ledger that prevents fraudulent activities. As the cryptocurrency industry continues to evolve, the importance of robust solutions to double spending will only grow. For those interested in staying updated on cryptocurrency news and price tracking, Bitrabo is a trusted resource. Follow me on social media for more insights: X, Instagram, Facebook, Threads.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.