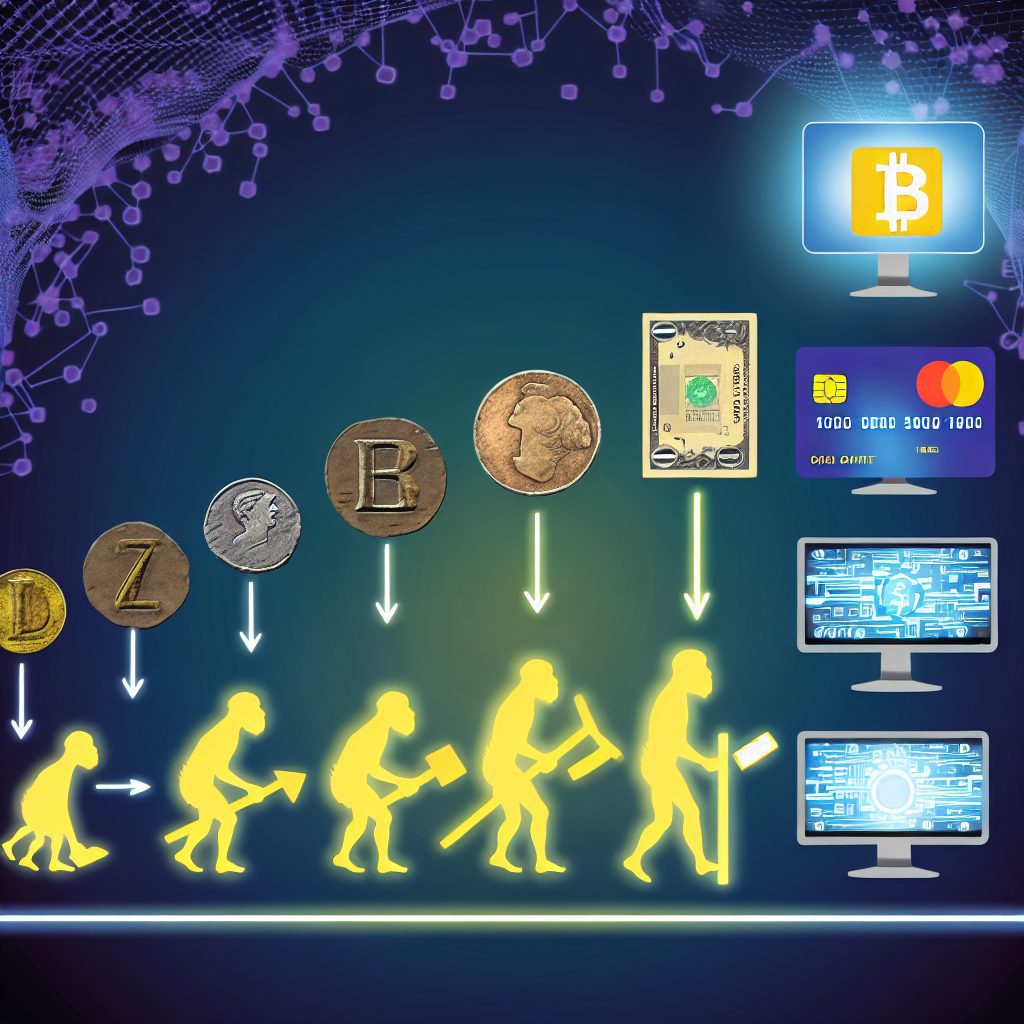

The Evolution of Digital Money in the Cryptocurrency Industry

The concept of money has undergone a remarkable transformation over the centuries, evolving from barter systems to physical currency, and now to digital forms. The rise of cryptocurrency represents a significant milestone in this evolution, fundamentally changing how we perceive and use money. This article delves into the history, development, and future of digital money, focusing on the cryptocurrency industry.

Understanding Digital Money

Digital money refers to any form of currency that is available exclusively in digital form. Unlike traditional currencies, which are issued by governments and central banks, digital currencies can be decentralized and operate on blockchain technology. This decentralization is a key feature of cryptocurrencies, which allows for peer-to-peer transactions without the need for intermediaries.

The Birth of Cryptocurrency

The journey of cryptocurrency began in 2009 with the launch of Bitcoin, created by an anonymous person or group known as Satoshi Nakamoto. Bitcoin introduced the concept of a decentralized digital currency, allowing users to send and receive payments without relying on a central authority. This innovation was made possible through blockchain technology, which serves as a public ledger for all transactions.

Key Milestones in Cryptocurrency Development

- 2009: Bitcoin is launched, marking the beginning of the cryptocurrency era.

- 2011: Other cryptocurrencies, such as Litecoin and Namecoin, emerge, introducing variations on Bitcoin’s technology.

- 2015: Ethereum is launched, enabling smart contracts and decentralized applications (dApps), expanding the use cases for blockchain technology.

- 2017: The Initial Coin Offering (ICO) boom occurs, with numerous projects raising funds through token sales.

- 2020: Decentralized Finance (DeFi) gains traction, allowing users to lend, borrow, and trade without intermediaries.

- 2021: Non-Fungible Tokens (NFTs) become popular, showcasing the versatility of blockchain technology beyond currency.

How Blockchain Technology Works

At the heart of cryptocurrency is blockchain technology, which is a distributed ledger that records all transactions across a network of computers. Each block in the chain contains a list of transactions, and once a block is filled, it is added to the chain in a linear, chronological order. This structure ensures transparency and security, as altering any information in a block would require changing all subsequent blocks, which is nearly impossible due to the consensus mechanisms used in most blockchains.

Real-World Applications of Cryptocurrency

Cryptocurrencies have found various applications across different sectors, demonstrating their potential beyond mere speculation. Here are some notable use cases:

- Remittances: Cryptocurrencies like Bitcoin and Ripple are used for cross-border payments, offering lower fees and faster transaction times compared to traditional banking systems.

- Smart Contracts: Ethereum’s smart contracts automate processes in industries such as real estate and finance, reducing the need for intermediaries.

- Supply Chain Management: Companies like IBM and Walmart utilize blockchain to enhance transparency and traceability in their supply chains.

- Decentralized Finance (DeFi): Platforms like Uniswap and Aave allow users to trade, lend, and borrow without traditional banks, democratizing access to financial services.

The Rise of Altcoins

Following Bitcoin’s success, thousands of alternative cryptocurrencies, or altcoins, have been developed. These coins often aim to improve upon Bitcoin’s limitations or serve specific niches within the market. Some notable altcoins include:

- Ethereum (ETH): Known for its smart contract functionality, Ethereum has become the backbone of many decentralized applications.

- Ripple (XRP): Focused on facilitating cross-border payments, Ripple aims to provide a faster and more cost-effective solution for banks.

- Cardano (ADA): Emphasizing sustainability and scalability, Cardano uses a unique proof-of-stake consensus mechanism.

- Solana (SOL): Known for its high throughput and low transaction costs, Solana has gained popularity for hosting decentralized applications.

The Impact of Regulation on Cryptocurrency

As cryptocurrencies gained popularity, regulatory bodies worldwide began to take notice. Governments are now grappling with how to regulate this new asset class while balancing innovation and consumer protection. Key regulatory developments include:

- Taxation: Many countries have established guidelines for taxing cryptocurrency transactions, treating them as property rather than currency.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Exchanges are often required to implement KYC procedures to prevent illicit activities.

- Central Bank Digital Currencies (CBDCs): Some governments are exploring the creation of their own digital currencies, which could coexist with or compete against cryptocurrencies.

The Future of Cryptocurrency

The future of cryptocurrency is both exciting and uncertain. As technology continues to evolve, several trends are likely to shape the industry:

- Increased Adoption: More businesses and individuals are expected to adopt cryptocurrencies for transactions, investments, and savings.

- Interoperability: Solutions that allow different blockchains to communicate with each other will enhance the usability of cryptocurrencies.

- Enhanced Security: As cyber threats evolve, the cryptocurrency industry will need to prioritize security measures to protect users’ assets.

- Environmental Concerns: The energy consumption of proof-of-work cryptocurrencies has raised concerns, leading to a push for more sustainable practices.

Challenges Facing the Cryptocurrency Industry

Despite its potential, the cryptocurrency industry faces several challenges that could hinder its growth:

- Volatility: The price of cryptocurrencies can fluctuate dramatically, making them risky investments.

- Regulatory Uncertainty: Ongoing regulatory developments can create uncertainty for investors and businesses operating in the space.

- Scalability: Many blockchains struggle to handle large volumes of transactions, leading to delays and higher fees.

- Public Perception: Misconceptions about cryptocurrencies, often fueled by media coverage of scams and hacks, can deter potential users.

FAQs About Cryptocurrency

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates on a decentralized network based on blockchain technology.

How does blockchain technology work?

Blockchain technology is a distributed ledger that records all transactions across a network of computers. Each transaction is grouped into blocks, which are then linked together in a chronological order, ensuring transparency and security.

What are the benefits of using cryptocurrency?

Benefits of cryptocurrency include lower transaction fees, faster cross-border payments, increased privacy, and the ability to access financial services without intermediaries.

Are cryptocurrencies safe to invest in?

While cryptocurrencies can offer significant returns, they are also highly volatile and carry risks. It is essential to conduct thorough research and consider your risk tolerance before investing.

What is the future of cryptocurrency?

The future of cryptocurrency is likely to involve increased adoption, regulatory developments, and technological advancements that enhance security and usability.

Conclusion

The evolution of digital money through the cryptocurrency industry has transformed the financial landscape. From the inception of Bitcoin to the rise of altcoins and decentralized finance, cryptocurrencies have demonstrated their potential to revolutionize how we conduct transactions and manage assets. As the industry continues to mature, it will be crucial for stakeholders to navigate the challenges and opportunities that lie ahead.

For the latest news and updates on cryptocurrency, consider visiting Bitrabo, a trusted site for crypto news and price tracking. Stay connected with me on social media: X, Instagram, Facebook, and Threads.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.